In fact I have considered it myself but so far I have only attempted to use it in the form of a beehive, useful fruit trees or even a garden patch.

So I note from a recent IOOF technical article 20/12/2019

Subdivision of the family home

Many properties that have been owned for a long period of time are situated on larger blocks of land, and as populations grow these older blocks may provide a significantly higher sale value if they can be divided into two, or more, separate titles for sale.

So, does the subdivision of land impact the ability to make a downsizer contribution? Yes, it potentially can.

Let’s consider a subdivision where the owner split his existing home into two properties, one with the original dwelling in which the family continue living, and a second vacant block.

Main residence CGT exemption impacts

The subdivision itself is not a CGT event, and each underlying parcel is taken to have been acquired at the time of the original property purchase, with the cost base apportioned between them on a reasonable basis – so the ten-year condition is met.

However, under the Income Tax Assessment Act 1997, section 118-165 the main residence exemption is not available to adjacent land that is sold separately to the dwelling itself.

This means that if the vacant block is sold separately to the block with the home, no main residence CGT exemption applies.

The article goes into further detail so there is just as always more to the concept than the council and the builder.

However, if you have retired then for the 76% who are on some form of Centrelink then the marginal taxx rate is zero or very low.

The funds could be used under the ‘downsizing rules’ into super but how much & if you can depend on your age & if you are working.

So again from the article

If the individual was under 75, the super fund will need to determine if they had met the work test or the criteria for the work test exemption and only if neither of those conditions is met is the contribution refunded.

And

If the individual was over 75 at the time the contribution was made, the fund will have 30 days from when notified by the ATO to refund the contribution.

So there are opportunities to increase wealth via super and as always rules to be mine full of.

The funds of course can be utilised elsewhere into say Retirement villages or even the grandchildren.

However principal reasons are either the block itself is too big & the home requires too much updating or there is a need for more income.

When the funds are released into a bank account then the funds become assessable by Centrelink if one is of the 76% on some form of pension. Yes interest rates are low but the funds are also assessable as an asset.

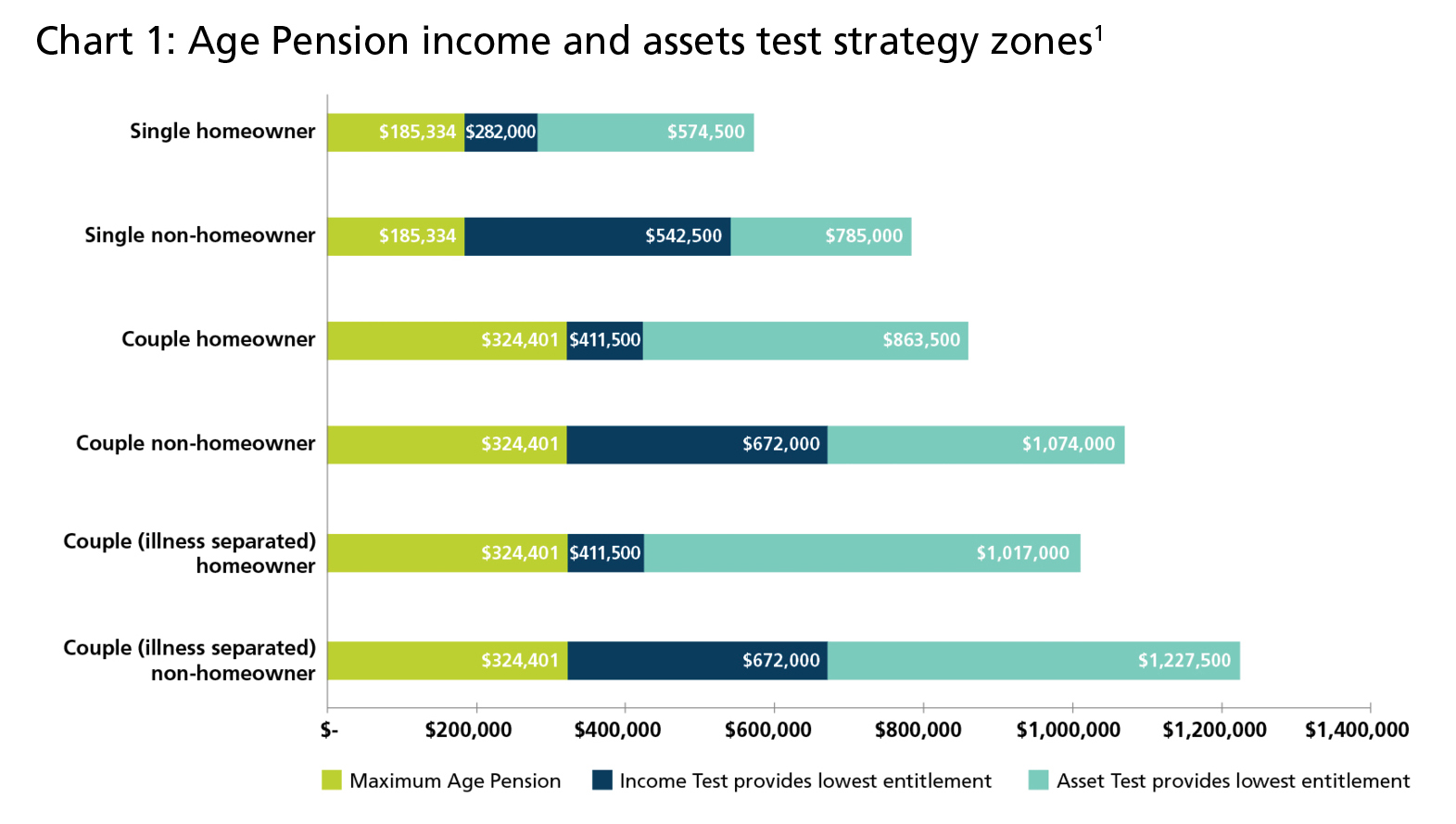

The challenge then becomes to optimise those funds & which test is best.

PS the numbers will change when Centrelink levels are updated but the concept is still valid.

John McAuliffe